Hillary Clinton will call for student loan forgiveness for social workers, others

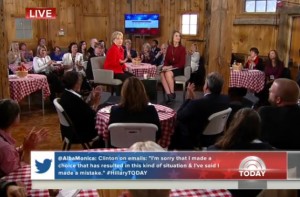

Democrat nominee Hillary Clinton answers audience questions during a town hall meeting in Hollis, N.H. Screenshot courtesy of NBC News.

Presidential candidate Hillary Clinton said she would seek student loan forgiveness for people in certain professions, including social workers, firefighters, teachers and police.

“I want to forgive loans if you go into national public service of some sort,” Clinton said today during a town hall meeting in Hollis, N.H. that was broadcast on NBC’s Today Show.

About 40 million Americans have student loans totaling $1.2 trillion dollars, Clinton said. Besides student loan forgiveness, Clinton said borrowers should be able to restructure student loan debts to make payments easier, community college should be free, and the costs of a college education should be reduced.

Visit the NBC News website to watch clips from the town hall meeting, including Clinton’s comments on student loans.

| Leave A CommentAdvertisement

22 Comments

Leave a Comment

You must be logged in to post a comment.

I am a mental health social worker and I owe 75,000. I now have a daughter in college and I can’t help her because of my debt.

Excellent! I hope she makes it retroactive too. A a retired social worker I am still trying to pay off student loans for my MSW.

There is a forgiveness program already for those in public service: https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/public-service. You can apply after 120 payments on the loan while working for the government or a non-profit. Granted, it needs to apply to private loans, start sooner than after 10 years, and be expanded, but it seems like the current program is worth highlighting, especially since some folks may not know about it (as it doesn’t seem widely advertised).

How about speech pathologist?

I have worked at the county child welfare office for almost 22years. As a single parent, I went back and got my MSW at 44 while still working and raising my daughter. I owe close to $60,000 in student loans as I continue to work and help her through school. My loan repayment plan isn’t enough to allow the payments to qualify toward loan forgiveness. I am stretched really thin and am now 55 years old. I don’t know if I will ever be able to pay it all back.

Don’t forget librarians! In many communities we’ve virtually taken over providing library services to children for schools. That should count.

Thank God! At least Hillary has the guts to publicly recognize that social workers in this country deserve a break. I am more than 40K in the hole for my MSW education. Like many other social workers, I bust my ass every single day to do the best possible job that I can in a system that is often broken beyond repair. Anyone in this field sure as hell knows coming into it that it ain’t for the bucks -It’s because we love what we do! We need to push for this, folks! Let’s make 2016 OUR year!

This would be fabulous. As a social worker, I know about the public service forgiveness… What people don’t know it that it doesn’t cover all Social Work positions. This would be fabulous. Even if it could be sooner than 10years.

I went to school for nine years, graduating in June 2013. I left there with my dual Masters, a master of science in social work and I am master of science in criminal justice. What was a three-year part time became a 4-year part timeprogram at a private university. That private university charge to me over $159,000. There are a few that do that; USC, Loma Linda, and a couple others out here in California. At the end of the day, I am making nearly $70,000 a year after being in LA for 2 years now. That still does it do it because I work overtime on top of that. So my payments only $400; to be $391.44 a month. I got it down to this but as a 53 year old late in the field, I still have a17 year old at home. I don’t even have a home of my own. But working on some options. It would be so nice to get an even better rate. I’m currently working on a Public Loan Service Forgiveness option. I hope whoever gets in, they look at how many went into professions that work with the mentally ill/disabled, especially when they are single parents.

Licensed clinical workers can get plenty of student loans paid off through the National Health Service Corps. Work in an undeserved area in the U.S. for 2 years and get $50,000. Add additional years and get $25000 to $35000 for each year. Just Google NHSC LOAN REPAYMENT and you’ll find your way. Good luck!

This is great news, I hope this loan forgiveness is a sure thing. Being a social worker and working for non-profits I owe over 100,000 in school loans and will never pay them back if I don’t get some help.

That is the best news I have heard in a while! I am a licensed master social worker, and my student loan debt is close to $80,000.00. I hope this happens.

Timely announcement by candidate Clinton and timely coverage from Social Workers Speak: today at the Massachusetts State House legislators heard testimony from BSW and MSW students and professionals with unwieldy student loans. Professionals working for $35,000/year or fee-for-service with $100,000 in loans. Support social workers and give them loan relief!

I am an LCSW and LSAC with over $100,000 in student loans. I work in social services since before I completed my Bachelors Degree and AM very grateful and proud of my education. I feel like I have a spectacular education and I’m thrilled that I’ve been able to actually put it into use consistently since the time I acquired it. I have even managed to figure out a way to do just about exactly what I want and make a decent living with it by owning and operating with social service agency that is quickly growing in our area. We have a reputation of working with some of the most difficult clients in our part of the state. The National loan forgiveness program is an excellent option if you can find an approved site in the underserved areas. My agency opens and office specifically because it was cited as one of the underserved area and did absolutely everything we were asked to become an approved site so that our cells and the people that work with us could benefit from the opportunities of the forgiveness program. However after 5 years of that effort they decided that our home base work could not be considered in the consideration of our proportions of services provided in the community. Not sure about your experience, but often it’s been my experience that home-based work can be as OR more intensive than office based services. We provided in office and in home and community based services for this community. In fact, we are probably one of less than five providers and the second largest available for that community. We had to close the office because we couldn’t convince anybody to work out there, it’s a good distance from populated areas and has a rather rural area. If we had been approved as a loan forgiveness site, we would have most certainly been able to ensure that would go out there. There are pretty strict restrictions to access this program, however like I said previously if you can access it it’s a great option. I’m pretty sure that I will never pay my loans off. I will be pleased if I figure out a way to live my life and support my children and not leave this debt to them in the end. It’s a shame, because I do absolutely believe that I should pay for my own bills. However I will have paid almost double in interest because I couldn’t pay it quick enough. It was certainly a valuable use of my financial resources, but has impacted my life possibilities since that time and sadly, has remained one of the most stressful elements life:) still, I believe that a good education is one of the best things we can give ourselves…for reasons for more intimate than financial interrests, self-worth, the power that is afforded to knowledge, the pure love of learning and interest and so many more. I just pulled out hope that I’ll either be able to continue to manage it or there will be another option sometime in the near future.

peace

I am currently pursuing my BSW and I am a graduating senior. Although I the feeling of empowering clients lives is something that I am passionate about, I have accumulated quite a bit debt from student loans. I also plan on pursuing my masters at an out of state university, however, I wory that my financial limitations may limit the location and type of training I may be able to pursue.

I finally was able to pay off my student loan when my parents died in 2011. I am 68 years old and just opened my private practice to be able to do group work & individual sessions with people with PTSD, trauma, abuse, pain management, substance abuse for military, seniors and people of all ages. My husband is 80 years old and still works as a psychotherapist in an agency. I am an LMSW & supervise LLMSWs. In our field we make little money but the rewards are everything to see an abused child or adult living in horrific situations. I could certainly welcome some financial assistance in simply covering the start up fees. I haven’t used credit cards in years until now just to get this going. I love my patients. I am a holistic practice offering NADA auricular acupuncture, clinical and medical hypnotherapy in addition to conventional modslities. If I had the money I would want to open a non-profit to help cover costs for those people who have so little or nothing. I have offices in Farmington Hills and Warren, Michigan. Any suggestions?

I am voting for Bernie Sanders. Tuition should be free to all Americans. Hillary is too late in the game and most importantly lacks integrity. She is bought and paid for by Special Interest, Wall Street, Goldman Sachs etc. GO BERNIE GO!!!

I totally agree. All college students should be able to restructure their loans whether they are federal or private loans. Our daughter owes over 100,000 dollars between federal and private loans. She attended 5 years to a in state college. We hit hardship during the time she attended and she had to borrow all the money to attend. We got no breaks from Fasfa. My husband and I both work for a high end cabinetry shop and when the economy took a crap,we took a 25% pay cut and were on unemployment off and on for about 6 yrs. None of these private lenders will help with consolidating to a fixed interest to help lower payments that are manageable for her to pay back. They dont care. We co signed her loans and in reality the banks should have not lent her the money, they went completely by our credit scores and not by our total income which decreased by 25%. We all know that when the students graduate they do not make enough money to pay these loans back. There needs to be help in the private student loan debt. Our daughter is the unable to move out-she cant afford to rent or own. In case you are wondering-we are white-another reason why there is no help.These banks need to be made to consolidate with these students so the payments are not a hardship for them. My daughter has always had the intention ( and is paying them back) but would just like some breathing room. The student loan debt through fedral and private loans will be the next bubble that bursts.This is also another reason why our graduates can not contribute to the economy. Something needs to be done now!

Sincerely

Tracy Buch

Tracybuch8@comcast.net

How about ANYONE working hard who attended college to better their life and now in debt from school loans??? Teachers, teacher aides who are underpaid….

I became disabled and was unable to pay my student loans so I applied for, and was granted the “forgiveness” program. What I did not know is that was reported to the IRS and a form was generated that caused the amount forgiven to be taxed as income! I had to use most of my settlement $ from the accidents that caused the disability to pay that tax. Our tax code is so very unfair!

No matter which politician puts through a program to forgive our student loans, that issue must be addressed! Few, if any of us have the $ to pay tax on such a large amount of money!

Hello everyone I am a College and Retirement Planner I work for a company call College Funding Resources we teach student and parents (How to Pay Zero for College) and for those of you who have student loan debt we can help you get rid of that debt I invite you to go to our website and sign up or call me directly 248 943-6264. http://www.tuitionreductionplan.com Sincerely Amanda G Boyd

It is now July 23m 2017 and we are still paying on our student loans. I guess Hillary forgot about us.